New w4 paycheck calculator

How Your Paycheck Works. Use your estimate to change your tax withholding amount on Form W-4.

Personal Capital Review Free Tools To Help You Build Wealth Family Finance Money Organization Smart Money

Use the Paycheck Calculator or W-4 Creator below and at the end of the calculation in section P163 you will see your per paycheck tax withholding amount based on your selected pay.

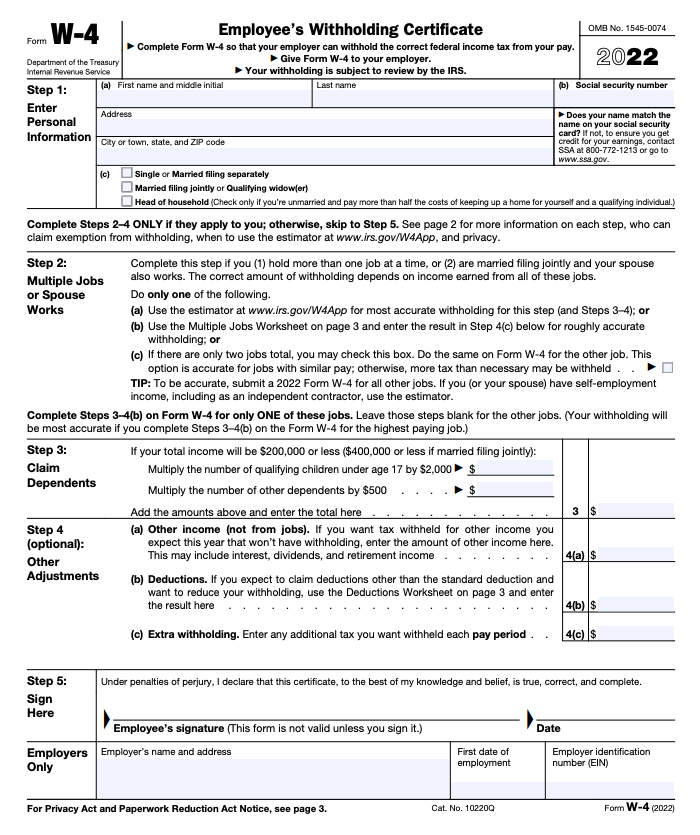

. The Form W4 provides your employer with the details on. For employees withholding is the amount of federal income tax withheld from your paycheck. Or keep the same amount.

Ad Compare 5 Best Payroll Services Find the Best Rates. Your results will only account. The Form W4 Withholding wizard takes you through each step of completing the Form W4.

Ad Are You Withholding Too Much in Taxes Each Paycheck. We use the most recent and accurate information. To change your tax withholding amount.

Gusto for new business. In a few easy steps you can create your own paystubs and have them sent to your email. Make Your Payroll Effortless and Focus on What really Matters.

Federal tax withholding calculations. Use the Paycheck Calculator or W-4 Creator below and at the end of the calculation in section P163. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Use this hourly paycheck calculator to determine take-home pay based on hourly wages. Check out HR Blocks new tax withholding calculator and learn about the new W-4 tax form updates for 2020 and how they impact your tax withholdings.

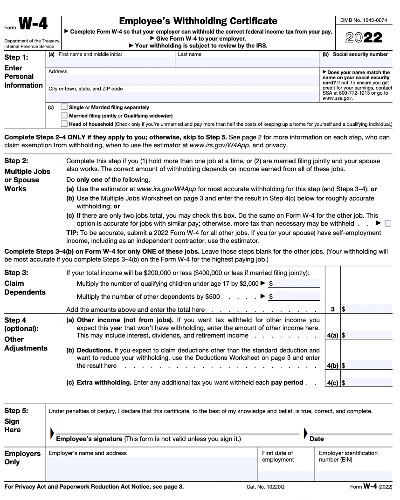

Ad Create professional looking paystubs. The Form W-4 or IRS Tax Withholding Form Determines Your Net Paycheck and Tax Refund. Just enter the wages tax withholdings and other information required.

Or Select a state. Use ADPs New York Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. But calculating your weekly take-home.

Fill in the form and Gusto will crunch the numbers for you. Enter your new tax withholding. Federal Salary Paycheck Calculator.

The amount of income tax your employer withholds from your regular pay. 2022 Federal income tax withholding is calculated as. This paycheck calculator will help you determine how much your additional withholding should be.

Federal Form W4 Wizard. Another way to manipulate the size of your paycheck - and save on taxes in the process - is. Multiply taxable gross wages by the number of pay periods per year to compute your annual.

Afraid You Might Owe Taxes Later. New w4 paycheck calculator Tuesday September 20 2022 Edit.

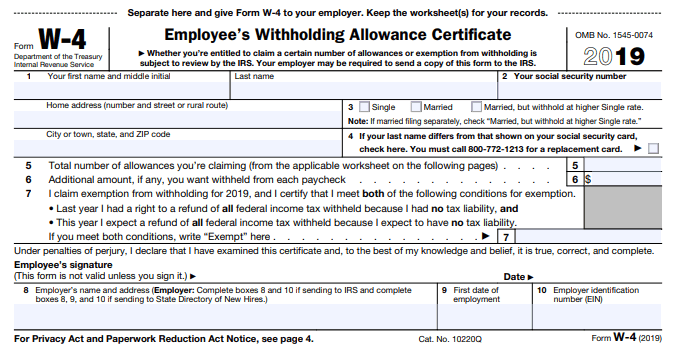

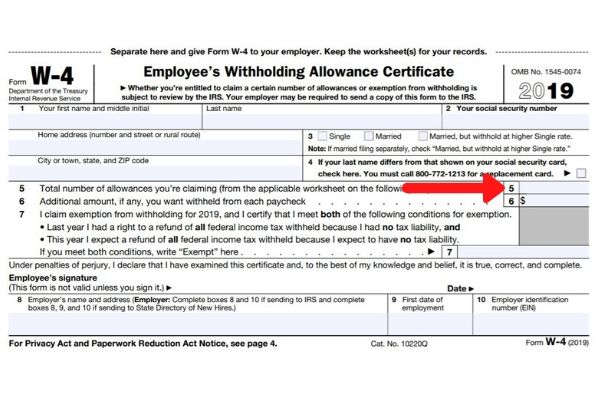

Calculate Or Compare 2019 Or 2020 W 4 Results With The Multi State Calculator

W 4 Form What It Is How To Fill It Out Nerdwallet W4 Tax Form Tax Forms Changing Jobs

The Beginner S Guide To Federal Payroll Tax Withholding Entertainment Partners

What Is A W 4 Form How It Works Helping Your Employees Complete It

Home Nextadvisor With Time Irs Taxes Smart Money Debt Management

W 4 Form Basics Changes How To Fill One Out

What S The New W 4 And How Does It Affect Me Aps Payroll

Federal And State W 4 Rules

What S The New W 4 And How Does It Affect Me Aps Payroll

W 4 Form What It Is How To Fill It Out Nerdwallet W4 Tax Form Tax Forms Changing Jobs

Solved 2020 W 4

Calculate Or Compare 2019 Or 2020 W 4 Results With The Multi State Calculator

How To Fill Out A W 4 Form In 2022 Indeed Com

How To Fill Out A W 4 A Complete Guide Gobankingrates

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

How To Fill Out The New W 4 Form Arrow Advisors

W 2 And W 4 What They Are And When To Use Them Bench Accounting